Policyholders Paying More, Receiving Less

The rising cost of medical insurance has become a pressing issue for Malaysians, with policyholders facing higher premiums while their access to healthcare facilities continues to shrink. Recent industry developments highlight a troubling trend – insurance companies reporting record profits while pushing to remove panel hospitals and reduce coverage options.

Record Profits Amidst Rising Costs

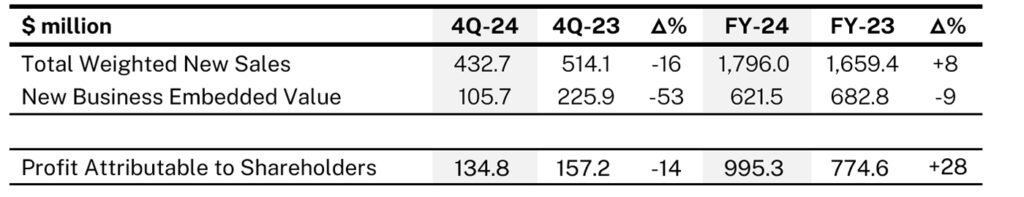

Despite claims that rising healthcare costs necessitate premium hikes, Malaysia’s top insurance companies have reported substantial financial gains:

- Great Eastern reported a 28% surge in annual net profit, hitting nearly RM4.7 billion.

- Allianz Malaysia posted a 19.1% year-on-year increase in net profit for the final quarter of 2024 in 2024.

- AIA’s net profit surged 47.2% in the first half of 2024.

If insurers are facing increasing costs, why are their profits reaching historic highs? While insurers often attribute premium increases to rising medical expenses, the simultaneous growth in their investment portfolios suggests that policyholders are shouldering a disproportionate burden.

Fewer Panel Hospitals, Limited Access for Patients

Adding to the concerns, many private hospitals are being removed from insurance panels. The Association of Private Hospitals Malaysia (APHM) recently warned that several member hospitals may soon be delisted due to insurers’ demands for unsustainable cost reductions. This could lead to significant consequences for patients, including:

- Fewer hospital choices for policyholders.

- Increased instances of “pay first, claim later” scenarios, which may result in rejected reimbursements.

- Delays in receiving critical medical treatments, particularly for specialized care.

Understanding the Cost Structure of Private Healthcare

A key argument in the ongoing debate is the comparison between private and public hospital charges. Public hospitals benefit from government subsidies, whereas private hospitals reinvest earnings into medical advancements, specialist recruitment, and facility upgrades. Expecting private hospitals to align their pricing with public institutions disregards the structural and financial differences between the two systems.

Private hospitals allocate revenue towards:

- Upgrading medical technology and providing cutting-edge treatments.

- Attracting and retaining experienced medical professionals.

- Expanding facilities to enhance healthcare accessibility.

Conversely, insurance companies do not reinvest in healthcare infrastructure or patient care. Instead, their cost-saving measures often manifest as policy limitations, restricted hospital access, and adjustments to treatment coverage (such as prioritizing generic drugs over doctor-recommended options).

As insurance premiums continue to rise while hospital access diminishes, there is an urgent need for regulatory intervention.

Key questions must be addressed:

- Why are policyholders paying more while receiving reduced healthcare options?

- Should insurers be allowed to dictate medical treatment choices and restrict access to hospitals?

- What measures can be introduced to ensure greater transparency and fairness in medical insurance policies?

Regulatory bodies such as Bank Negara Malaysia (BNM) and the Ministry of Health (MOH) must play a more active role in overseeing these developments. Clearer policies should be established to prevent abrupt panel removals, ensuring that patients are not left without adequate medical options.

Malaysia’s healthcare system relies on the balance between public and private institutions. While cost efficiency is a valid consideration, it must not come at the expense of patient care and accessibility. A sustainable model should involve fair pricing structures, reasonable premium adjustments, and a healthcare system that prioritizes patient well-being over profit maximization.

The ultimate goal should be a transparent, fair, and patient-centric healthcare ecosystem. -MalayaDailyToday