PUTRAJAYA – The Malaysia International Humanitarian Organisation (MHO) has urged the Malaysian Anti-Corruption Commission (MACC) to open an investigation under Section 18 of the MACC Act following complaints from 276 victims who collectively lost RM104.94 million to alleged fraudulent real estate and Syariah Redeemable Preference Share (i-RPS) investment schemes.

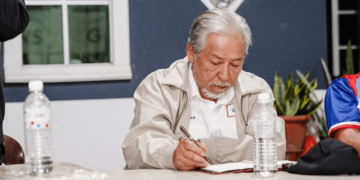

MHO Secretary-General Datuk Hishamuddin Hashim said the complaints involve several local companies that purportedly offered syariah-compliant investment packages but later failed to pay the promised dividends.

He revealed that one of the victims, Azmi, a 55-year-old retiree from Johor, lost RM2.25 million, wiping out his life savings including funds from Tabung Haji and the Employees Provident Fund (EPF) after joining the programme in November 2022.

“Azmi was lured after being approached by an agent with a ‘Datuk’ title and told the scheme was led by influential religious figures. He was promised a 15% dividend and initially received seven payments before everything stopped in 2024,” Hishamuddin said.

“He has lost all his retirement savings and is now forced to return to work to support his family. Many victims are retirees who relied on these savings for their old age,” he added.

According to Hishamuddin, preliminary checks showed the companies involved are not recognised as legitimate licensed entities, and funds collected from investors were allegedly channelled to other parties without their knowledge.

He said the modus operandi was consistent across the companies: dividends were paid in the initial months to gain trust before stopping abruptly, after which victims were given fake or misleading documents to delay legal action.

“Various excuses were given to confuse victims. Based on our information, nearly 1,000 individuals may have fallen prey to these schemes,” he said.

MHO previously lodged reports with the police, Companies Commission of Malaysia (SSM), Attorney-General’s Chambers (AGC), and Bank Negara Malaysia (BNM), but stressed that MACC action is now crucial.

In its formal media statement, MHO said the victims are urging investigations under Section 18 of the MACC Act, which deals with falsified or misleading documents used by agents to deceive principals.

The section states:

“A person commits an offence if he gives an agent, or as an agent uses, with intent to deceive his principal, any receipt, account or other document which contains any statement that is false, erroneous or incomplete.”

Hishamuddin noted that a similar case was investigated by MACC under the same provision in late 2024, with an almost identical modus operandi.

“Today’s complaint is a joint initiative by MHO and the victims. We appreciate MACC’s cooperation and the victims are ready to submit all relevant documents to assist the investigation,” he said.

Founded in 2016, MHO focuses on humanitarian aid and legal assistance for victims of exploitation and fraud. Hishamuddin said the organisation will continue supporting all affected investors until decisive action is taken. -MalayaDailyToday