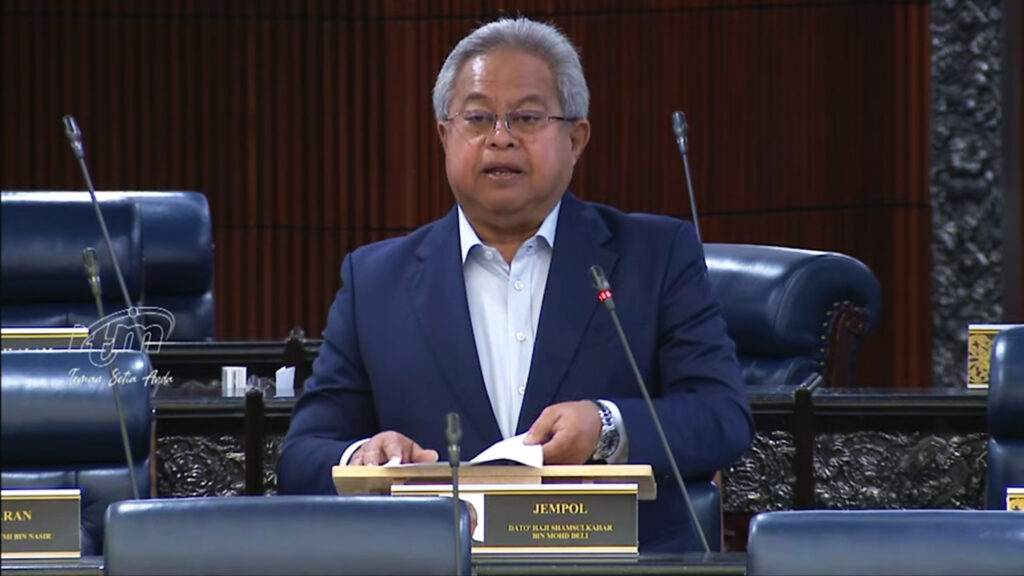

KUALA LUMPUR – Recently, the courier and last-mile delivery sector one of the fastest-growing pillars of Malaysia’s digital economy was thrust into the spotlight after Jempol MP raised a detailed warning in Parliament about alarming structural distortions that he said were endangering the survival of local operators and the long-term health of the industry.

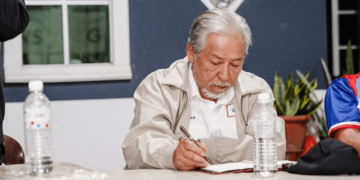

Speaking during the committee-stage debate of Budget 2026 for the Communications Ministry, the MP, Datuk Shamsulkahar Mohd Deli said Malaysia’s courier ecosystem had evolved into a critical infrastructure supporting more than 150,000 jobs.

The sector, he noted, underpins e-commerce, micro-entrepreneurship, SME fulfilment, and the nation’s broader digitalisation agenda.

However, citing the latest market data, he told the Dewan Rakyat that a sharp concentration of market share was beginning to emerge, signalling what he described as an unhealthy and rapidly growing imbalance between a few dominant companies and dozens of small and medium-sized local operators struggling to stay afloat.

Below-cost delivery rates creating “destructive price war”

A central issue, he said, was the escalating predatory pricing where several large companies allegedly offer parcel delivery rates far below operational cost.

He pointed out that although the actual cost of handling a small parcel is about RM2.50, some major players were charging only RM2 or RM3 merely to seize market share at any cost.

He stressed that such behaviour was not normal discounting but a deliberate strategy aimed at weakening smaller players and eventually forcing them out of the market.

Smaller courier companies, he said, were being pushed into loss-making operations simply to remain competitive. Many were “burning money” just to retain customers, placing immense strain on their financial sustainability.

He reminded the House that while the Communications Ministry issued the 2022 Reference Pricing Guidelines, the document remains advisory rather than mandatory, leaving room for aggressive price manipulation among dominant industry players.

“Masking” on e-commerce platforms restricting market access

The MP also raised what he termed an increasingly common but less publicly discussed threat known in the industry as “masking.”

Under this practice, major e-commerce platforms do not allow buyers to select their preferred courier service.

Instead, courier identities are hidden, with customers automatically routed to a single delivery company chosen by the platform, effectively restricting market freedom and disadvantaging other couriers.

Short-term cheap prices, long-term monopolistic costs

The MP warned that although consumers may currently enjoy lower delivery prices, the situation would reverse once monopolistic dominance takes hold.

Prices would rise, service quality would decline and workers would lose bargaining power, he said, adding that Malaysia’s digital economy could suffer long-term setbacks.

Calls for regulatory reform and minimum floor pricing

Jempol pressed the government to consider immediate intervention, including the introduction of a mandatory floor price to prevent destructive price wars.

He also urged regulators to investigate alleged exclusive arrangements between e-commerce giants and specific courier companies, warning that such practices may already be causing severe volume losses to other operators nationwide.

Review of licensing and control of foreign operators

The MP further called for a review of the courier licensing structure to ensure fair competition, particularly where foreign-backed companies may possess disproportionate market strength.

Minister’s Response

Regulators instructed to examine pricing and competition issues

Communications Minister Fahmi Fadzil responded the following day, assuring the Dewan Rakyat that MCMC and MyCC were scrutinising pricing practices in the courier sector, including whether below-cost rates indicate coordinated anti-competitive behaviour.

Minimum pricing under active consideration

Fahmi confirmed that the government is evaluating the feasibility of introducing a sector-wide minimum delivery price to stabilise the ecosystem and protect smaller players from unsustainable price wars.

Investigation into “masking” and platform exclusivity

He said authorities are also examining claims of exclusive delivery routing arrangements and non-transparent masking practices on major e-commerce platforms.

Licensing regime under review

He added that a structural review of courier licensing is underway to prevent market distortions linked to excessive foreign influence. -MalayaDailyToday